Compound Interest Calculator

Compound Interest Calculator: A Simple Guide to Maximizing Your Savings

What is a Compound Interest Calculator?

A compound interest calculator is a tool that helps you calculate how your investment grows over time with compound interest. Unlike simple interest, which is calculated only on the initial principal, compound interest is calculated on both the initial principal and the accumulated interest from previous periods.

Why Use a Compound Interest Calculator?

A compound interest calculator helps you see how your investment can grow over time by automatically calculating the accumulated interest on your initial amount.. It allows you to forecast future values based on factors such as:

Initial investment

Interest rate

Compounding frequency

Time period

By inputting these values, you get a clear estimate of your investment’s growth.

Benefits of Using a Compound Interest Calculator

Time-saving: Manually calculating compound interest can be time-consuming and complex.

Accuracy: A calculator provides precise results based on the data entered.

Financial Planning: It helps you plan for future goals, whether for retirement, education, or savings.

Daily Compound Interest Calculator: Grow Your Investment Faster

What is a Daily Compound Interest Calculator?

A daily compound interest calculator calculates interest that compounds every day. Since interest is applied on a daily basis, your investment grows faster compared to monthly or yearly compounding.

How Does Daily Compounding Work?

In daily compounding, interest is added to your balance each day, and the next day’s interest is calculated on the new, higher balance. This results in exponential growth over time.

Why You Should Use a Daily Compound Interest Calculator

Faster Growth: Daily compounding helps your money grow faster, as interest is compounded more frequently.

Ideal for Short-Term Investments: This method is perfect for savings accounts or short-term investments that compound daily.

Monthly Compound Interest Calculator: A Practical Approach

What is a Monthly Compound Interest Calculator?

A monthly compound interest calculator helps you determine the interest that compounds every month. This is ideal for savings accounts, credit cards, and loans that use monthly compounding.

How Monthly Compounding Works

In monthly compounding, interest is calculated once a month on the balance of your account, including any interest from previous months.

Benefits of Monthly Compounding

Easier to Track: Monthly interest calculations are simpler and more predictable.

Common in Financial Products: Many loans and savings plans compound monthly, making this calculator a must-have.

NerdWallet Compound Interest Calculator: A Trusted Tool for Your Finances

What is the NerdWallet Compound Interest Calculator?

The NerdWallet compound interest calculator is a popular online tool that helps you estimate the growth of your investments or savings over time with compound interest. It’s trusted by millions of users due to its simplicity and accuracy.

How to Use the NerdWallet Calculator

Enter your initial investment.

Set your interest rate.

Choose your compounding frequency (daily, monthly, etc.).

Enter the duration (in years) you intend to keep your investment.

Why Choose NerdWallet?

NerdWallet is known for providing clear, user-friendly financial tools that make it easier to make informed decisions.

CD Compound Interest Calculator: Maximizing Your Certificate of Deposit Earnings

What is a CD Compound Interest Calculator?

A CD compound interest calculator helps you calculate the growth of your Certificate of Deposit (CD). CDs offer a fixed interest rate for a set term, and the interest compounds periodically.

How Does a CD Work?

A Certificate of Deposit (CD) allows you to invest your money for a set period—usually from a few months to several years—while earning a fixed interest rate. The interest is compounded based on the frequency you choose (daily, monthly, or annually).

Why Use a CD Compound Interest Calculator?

Accurate Projections: It helps you project your returns based on the fixed interest rate.

Comparison Tool: Easily compare different CD options to find the best return.

Continuous Compound Interest Calculator: For the Advanced Investor

What is a Continuous Compound Interest Calculator?

A continuous compound interest calculator allows you to calculate the interest that compounds continuously, at an infinite frequency. This is often used in more advanced investment scenarios and financial theory.

How Continuous Compounding Works

With continuous compounding, interest is constantly calculated and added to the principal, leading to the fastest possible growth of your investment.

When to Use Continuous Compounding

Advanced Investments: This calculator is used by those dealing with theoretical finance or very high-frequency investment models.

Mathematical Simulations: Perfect for testing mathematical models and theories in finance.

401k Compound Interest Calculator: Planning for Your Retirement

What is a 401k Compound Interest Calculator?

A 401k compound interest calculator helps you estimate how your 401k retirement savings will grow over time. It factors in regular contributions, compound interest, and your investment timeline.

How It Helps Your Retirement Planning

Using a 401k compound interest calculator, you can plan how much money you will have at retirement, taking into account employer matches and the growth of your funds.

Why You Should Use a 401k Compound Interest Calculator

Better Retirement Planning: Understand how much you need to save to achieve your retirement goals.

Predict Your Future Savings: Get a clearer picture of your retirement fund’s growth.

What Are the Benefits of Using a Compound Interest Calculator?

Why Should You Use a Compound Interest Calculator?

Using a compound interest calculator offers several benefits:

Helps Plan for the Future: It allows you to understand the power of compound interest and how it can help grow your savings.

Saves Time and Effort: Rather than doing manual calculations, these tools save time and reduce human error.

Customizable: Most calculators allow you to tweak variables such as interest rates, compounding frequency, and time periods, giving you full control over your projections.

How to Do Compound Interest on a Calculator?

Steps to Calculate Compound Interest

To calculate compound interest manually, use this formula:

A = P × (1 + r/n)ⁿᵗ

Where:

A is the final amount

P is the principal

r is the annual interest rate

n is the number of times interest is compounded per year

t is the number of years

How to Build a Compound Interest Calculator in Excel

Create Your Custom Calculator

You can easily design your own compound interest calculator in Excel by following these simple steps:

Enter your variables: In separate cells, input the principal amount, interest rate, compounding frequency, and time.

Use the compound interest formula: In a new cell, use the formula =P*(1 + (r/n))^(n*t).

Adjust as Needed: Excel will automatically calculate your investment growth for you!

This method is especially useful if you want to personalize your calculations and tweak multiple variables.

How to Use a Compound Interest Calculator

Using the calculator is super easy. Just follow these steps:

Input the Principal Amount – This is the initial sum of money you plan to invest or deposit

Set Annual Interest Rate – Like 7%, 10%, or whatever rate you expect.

Select Compounding Frequency – Annually, Monthly, Daily, etc.

Enter the Investment Duration – Specify the total length of time you intend to keep your money invested..

Click ‘Calculate’ – Instantly see how much your investment will grow.

Example:

If you invest ₹50,000 for 10 years at 8% interest compounded annually:

Final amount = ₹1,08,061.23

Interest earned = ₹58,061.23

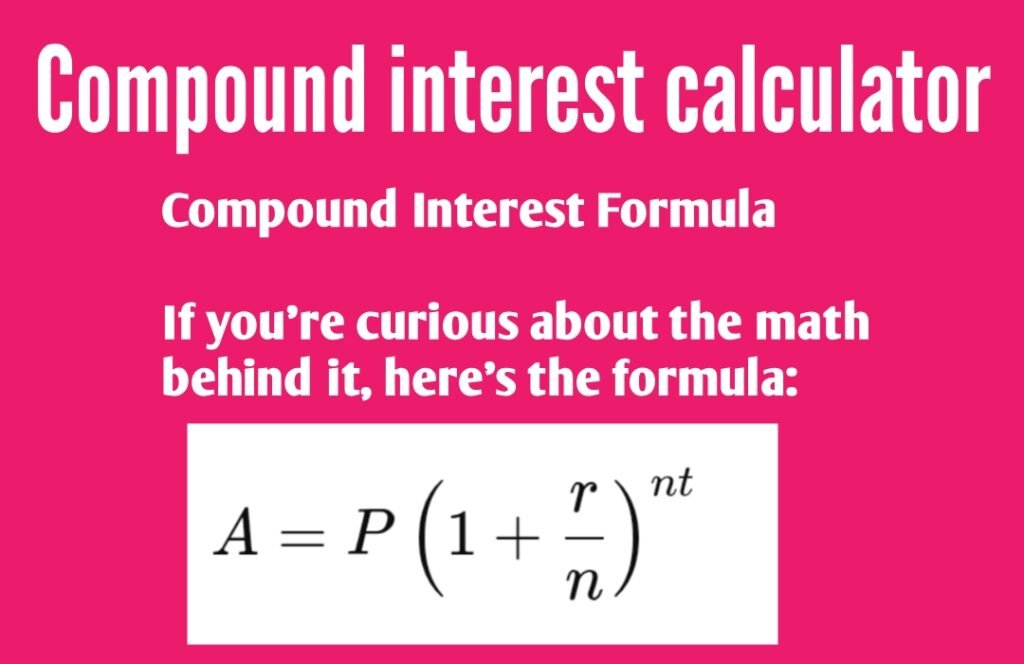

Compound Interest Formula

If you’re curious about the math behind it, here’s the formula:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}

Where:

A = Final amount

P = Principal amount

r = Annual interest rate (decimal)

n = The frequency with which interest is compounded within a specific time period

t = Number of time periods elapsed

Types of Compounding

Different compounding methods can affect your returns. Common options include:

Annually – Interest added once a year

Quarterly – Four times a year

Monthly – Every month

Daily – Every day (highest return)

The more frequent the compounding, the greater the final amount.

Real-Life Uses of Compound Interest Calculators

Saving for Retirement – Know how much to invest monthly to retire rich.

Fixed Deposits – Calculate FD maturity value instantly.

Mutual Fund Planning – Estimate long-term gains on SIPs.

Children’s Education – Plan for big future expenses wisely.

Loan Comparisons – Understand true cost of borrowing.

Benefits of Using Our Online Compound Interest Calculator

100% Free & Easy to Use

Instant Results with Detailed Breakdown

No Signup or Login Required

Mobile-Friendly Design

Works for Rupees, Dollars, or Any Currency

Compound Interest vs Simple Interest

Feature

Compound Interest

Simple Interest

Growth

Exponential

Linear

Interest On

Principal + Interest

Principal Only

Returns

Higher

Lower

Best For

Long-term Investments

Short-term Loans

Tips to Maximize Your Compound Growth

Start Early – Time is your biggest asset.

Invest Regularly – Consistency builds wealth.

Reinvest Returns – Don’t withdraw; let it grow.

Choose Higher Compounding Frequencies

Increase Contributions Yearly

Emi Calculator

Frequently Asked Questions (FAQs)

Q. Is compound interest better than simple interest?

Yes, especially for long-term investments. Compound interest grows your money faster.

Q. How often should interest be compounded for best results?

The more frequently, the better. Monthly or daily compounding gives higher returns.

Q. Can I use a compound interest calculator for SIP or mutual funds?

Yes, it’s great for estimating returns on recurring investments too.

A Compound Interest Calculator is more than just a math tool—it’s your gateway to financial freedom. With just a few clicks, you can discover how your money grows and how small investments can turn into big wealth over time.

Ready to start?

Try our Free Compound Interest Calculator now and see your future wealth grow!

Oscar Health Insurance: A Comprehensive Guide

Conclusion: How to Use a Compound Interest Calculator for Better Financial Planning

Whether you’re calculating daily compound interest, planning for retirement with a 401k calculator, or figuring out how much you’ll earn on a Certificate of Deposit, compound interest calculators are essential for anyone serious about growing their wealth. These tools simplify complex financial calculations and empower you to make more informed decisions about your money.

By using the right compound interest calculator for your specific needs, you can maximize your returns and better plan for the future.

Keywords to Target (for SEO):

Compound Interest Calculator

Online compound interest calculator

Compound interest formula

How to calculate compound interest

Investment growth calculator

Best compound interest calculator online

SIP compound calculator

Compound interest benefits